About Live Stream Too busy to watch TV? ARY News – Pakistan’s largest and the most sought-after media channel – brings to you an amazing option to watch LIVE...whatever is happening in the world right now. You just need a right device and an access to Internet for visiting live.arynews.tv on the go from anywhere. So, keep going LIVE with ARY News.

ISLAMABAD: Prime Minister Shehbaz Sharif has approved the summary for the appointment of Field Marshal Syed Asim Munir as both the Chief of Army Staff (COAS) and the country’s first Chief of Defence Forces (CDF). According to reports, the approved summary has been forwarded to the Presidency.Under the new arrangement, Asim Munir will simultaneously serve as Army Chief and Chief of Defence Forces for a tenure of five years. His appointment marks the first time Pakistan is formally establishing the post of Chief of Defence Forces.The prime minister has also approved a two-year extension in the tenure of Air Chief Marshal Zaheer Ahmad Babar Sidhu. The extension will take effect after the completion of his current five-year term in March 2026.https://www.youtube.com/watch?v=A19AiEWdo00Earlier, Federal Law Minister Azam Nazeer Tarar stressed that notification regarding the appointment of Field Marshal Asim Muneer as Chief of Army Staff (CAS) and Chief of Defence Forces (CDF) could be issued at any moment.While talking to the media, Azam Nazeer Tarar stated that there is no ambiguity whatsoever under Article 245, or within any of the Air Force, Army and Naval Acts. It has been written that whoever is the Army Chief will be the CDF.He noted that under the 2024 amendments, the tenure for service chiefs was extended from three to five years, and the legislation allows re-appointment or partial extension. 'I am announcing that General Asim Munir is the Chief of Defence Forces' On December 01, 2025, Federal Minister Hanif Abbasi announced on Monday that General Asim Munir is the Chief of Defence Forces (CDF), debunking all the rumours spread by unscrupulous elements on social media. In an exclusive interview with ARY News, Federal Minister Hanif Abbasi stated, “I am announcing that General Asim Munir is the Chief of Defence Forces. I had also mentioned two days ago that General Asim Munir is a Field Marshal.” Abbasi further hinted at the formality, saying, “The notification might have been issued. It is our will to announce it whenever we want. The respect that God has bestowed upon Pakistan through the Field Marshal is unparalleled; he shot down Indian aircraft while remaining within our limits, which the world is acknowledging.”Criticism of PTI and Remarks on Army Chief Appointment Commenting on the PTI, Hanif Abbasi used a local proverb (similar to ‘wishful thinking’), saying, “PTI’s situation is like a cat dreaming of scraps.” He added, “We have seen many prisons but never conspired against the country. Who staged a long march when he [General Asim Munir] was becoming Army Chief, trying to stop him? Wasn’t the Prime Minister threatened? But Asim Munir became the Army Chief.”

ISLAMABAD: The Anti-Terrorism Court (ATC) in Islamabad has begun proceedings to declare Khyber Pakhtunkhwa Chief Minister Sohail Afridi and several others proclaimed offenders after repeated failures to appear in cases linked to the November 26 protest, ARY News reported.The hearing was conducted by ATC Judge Abu Al-Hasanat Muhammad Zulqarnain.According to details, CTD Islamabad formally requested the ATC to initiate proclamation proceedings, stating that Sohail Afridi is nominated in terrorism-related cases but has continuously avoided appearing before the court.The CTD informed the judge that non-bailable arrest warrants issued for Afridi and co-accused Meena Khan Afridi and Dr Amjad have remained unexecuted.https://www.youtube.com/watch?v=0nFB5K4nPn0The CTD petition requested that a proclamation under Section 87 be issued, declaring all accused individuals as proclaimed offenders.The court, acknowledging the warrants’ non-execution and multiple ignored summons, directed authorities to paste proclamation notices outside the residences of Sohail Afridi, Meena Khan Afridi, and Dr Amjad.CTD Islamabad further stated that two terrorism cases are registered against Chief Minister Sohail Afridi in the federal capital.Earlier, Khyber Pakhtunkhwa Chief Minister (KP CM), Sohail Afridi, said IHC CJ Justice Dogar ‘denied’ meeting him as he sought meeting permission with the party founder.Sohail Afridi, Aleema Khanum, and their legal team reached the IHC to file plea for meeting with the PTI founder and meet the CJ, but later, departed after being informed by the Chief Justice’s secretary office that the meeting could not take place.Speaking to the media at the Islamabad High Court, KP Chief Minister Sohail Afridi said, “We were not heard. A message was conveyed from the Chief Justice stating that he cannot meet us.”He further announced that it has been decided not to allow the National Assembly and Senate sessions to proceed today. Sohail Afridi said that next Tuesday, supporters will gather outside the Islamabad High Court as well as outside Adiala Jail.“What is happening today will be remembered and will never be forgotten,” the KP CM said, adding that the sit-in outside Adiala Jail has concluded and the next course of action will be announced on Tuesday.

KARACHI: A major fire broke out at a textile factory in the Landhi Export Processing Zone in Karachi, with authorities declaring it a third-degree blaze as firefighting efforts continue.According to rescue officials, the fire initially erupted in a three-storey clothing factory before rapidly engulfing the building. The intensity of the flames increased significantly, causing parts of the structure, including the roof and sections of the walls, to collapse.Rescue teams have warned that the rear portion of the building may also collapse.Rescue 1122 teams report that chemical materials stored in an adjacent warehouse have raised fears that the fire could spread further.https://www.youtube.com/watch?v=G8nFO2ttUW4&t=5sEfforts to contain the fire are ongoing, with authorities attempting to prevent it from spreading to neighbouring warehouses and factories.The factory owner has also contacted rescue authorities, warning of severe losses if the fire is not controlled promptly.Fire brigade officials say more than 12 fire tenders, two snorkels, and teams from nearby factories have been deployed to the site. Additional vehicles have been summoned as crews struggle to contain the flames.The Karachi Water Corporation has also been called in to assist, and emergency measures have been enforced at the Landhi hydrant, with the Sherpao hydrant put on alert, according to an official spokesperson.Chief Fire Officer Muhammad Humayun Khan, speaking to ARY News, said firefighters are facing difficulties due to the scale of the blaze and structural damage, but are working continuously to gain control.He said they are aiming to bring the situation under control within one to one-and-a-half hours.Muhammad Humayun also confirmed that two KMC firefighters were injured during the operation and have been shifted to the hospital for treatment.

ISLAMABAD: Khyber Pakhtunkhwa's Adviser Finance Muzammil Aslam has said that the NFC session has decided to form different groups to tackle various issues.Chaired by Finance Minister Muhammad Aurangzeb, NFC session attended by chief ministers of Khyber Pakhtunkhwa and Sindh Sohail Afridi, Murad Ali Shah, provincial finance ministers, KP finance adviser, Chairman FBR and other commission members.Talking to media after the meeting, KP Adviser said that the NFC session was held with good ambience and each side was heard without any pressure.He said six to seven working groups will be constituted. "A working group will also be constituted over the issue of the Fata's inclusion in the financial structure," he said."All sides agreed to take along the matter," he said. "Nothing discussed with regard to decreasing the provincial share in Award," he added.

ISLAMABAD: Pakistan Railways (PR) has outsourced its schools to promote education. A signing ceremony to this effect was held in Islamabad today, Radio Pakistan reported.Railways Minister Hanif Abbasi witnessed the signing ceremony.Railway Boys and Girls School Karachi was formally outsourced to TYMS Education System, while Railway Girls High School Mughalpura Lahore and Railway Girls Saint Andrews School and College Lahore over to SAGE/DAGE Education Pvt. Ltd.This Pakistan Railways initiative is being implemented under the Public-Private Partnership model in line with the Prime Minister's vision, aiming to modernize Pakistan's educational institutions and ensure the protection of the rights of railway employees and their children.Under this initiative, the private partners will introduce a modern curriculum, advanced teaching methodologies, an upgraded examination system, well-equipped science and computer laboratories, sports facilities, and renovated school buildings.In October, Pakistan Railways generated Rs 13.547 billion in revenue by leasing its valuable commercial and agricultural land over the past five financial years, aiming to transform the department into a profitable entity.“The department has been leased out around 14,042 acres of railway land for various purposes through competitive bidding,” an official from the Ministry of Railways told APP.The official said that Pakistan Railways leases its land through open auctions under the Railway Property and Land Rules, 2023, which were approved by the Federal Cabinet.He said the efforts to generate non-fare revenue are being led by the Real Estate Development and Marketing Company (REDAMCO), a subsidiary of the Ministry of Railways.To a question, the official said the department has also decided to accelerate its ongoing anti-encroachment operations against land grabbers nationwide to reclaim railway land from individuals, groups, and even business organizations.

ISLAMABAD: Saudi Arabia has extended the tenure of the $3 billion deposit placed with Pakistan, ARY News reported on Thursday, citing well-placed sources.In November 2021, the SBP had signed an agreement with the Saudi Fund for Development (SFD) to receive $3bn, which would be placed in the central bank’s account with an aim to improve its foreign exchange reserves.The extension of the $3 billion deposit term will help Pakistan in shoring up its foreign exchange reserves and strengthening domestic economyThe Saudi Development Fund has approved a one-year extension for the $3 billion deposit, the sources said.They further say the tenure of the Saudi deposit was set to expire today. The $3 billion from Saudi Arabia is currently held with the State Bank of Pakistan.Saudi Arabia had initially signed the agreement in 2021 to provide Pakistan with the $3 billion deposit. Pakistan's bank deposits soar to new historic high Pakistan’s bank deposits have soared to a new historic high, reaching Rs. 31,626 billion in March 2025.The SBP report revealed a significant year-on-year increase of 11.7% and a month-on-month rise of 3.8% in bank deposits.Compared to March 2024, when deposits stood at Rs. 28,321 billion, an additional Rs. 3,305 billion was recorded over the year. In just one month, from February 2025’s figure of Rs. 30,457 billion, deposits grew by Rs. 1,169 billion.Pakistan posted a record current account surplus of $1.2 billion in March — the highest monthly surplus in the country’s history.

ISLAMABAD: The National Finance Commission's (NFC) inaugural session concluded on Thursday after deciding formation of six to seven working groups for structured roadmap for dialogue.The NFC session held today to discuss likely new revenue-sharing arrangement between the central government and federating units.The next session of the finance commission will be held on January 08 or 15 in 2026.The session also decided to form a working group over the issue of the former Fata region on the demand of the Khyber Pakhtunkhwa.Chaired by Finance Minister Muhammad Aurangzeb, NFC session attended by chief ministers of Khyber Pakhtunkhwa and Sindh Sohail Afridi, Murad Ali Shah, provincial finance ministers, KP finance adviser, Chairman FBR and other commission members.Four private members from provinces, Dr. Asad Syed (Sindh), Nasir Khosa (Punjab), Mehfooz Ali Khan (Balochistan) and Dr. Musharrif Rasool (Khyber Pakhtunkhwa) also been invited in the meeting.The NFC session postponed multiple times, formally notified by the President on August 22.The negotiations for sharing federal resources are likely to be complex, given the Centre complains resources constraints, rising debt servicing obligations and provincial demands for a larger share of the resources.

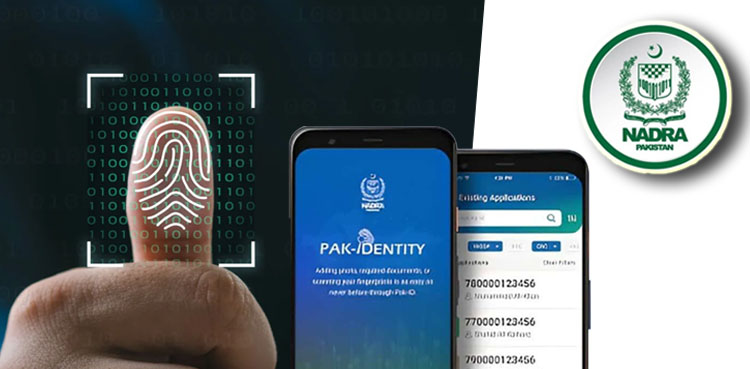

The National Database and Registration Authority (NADRA) on Thursday said over 500,000 citizens used the Pak ID mobile app to obtain their identity documents during October and November 2025.The announcement was made by the NADRA on its Facebook official account.Giving up the breakup of the services, the National Database and Registration Authority stated that among over 500,000 citizens, more than 270,000 citizens used the Pak ID mobile app for CNICs, over 70,000 citizens obtained Family Registration Certificates, more than 49,000 NICOPs, and over 83,000 citizens applied for B-Forms via Pak Id mobile app.Read More: NADRA shares new updates for CNIC renewal via Pak ID app National Database and Registration Authority offices across Pakistan continue to offer special facilities for persons with disabilities.NADRA stated its commitment to ensuring that no individual, regardless of the type of disability, is deprived of identity documentation.NADRA provides persons with disabilities a special identification card, issued free of charge for the first time and valid for life. To date, over 1 million ID cards with a distinctive mark have been issued. Facilities include: Executive category processing without queues Wheelchair availability at NADRA offices Priority services with special tokens Appointment booking via helpline Issuance of special identification cards First-time issuance free of charge and valid for life Over 1 million ID cards issued with a distinctive mark Disability registration Appointment booking through mobile app

KARACHI: Another NIPA manhole like tragedy was averted by locals in Karachi's Baldia Town area after a young girl fell into an open drain, ARY News reported on Thursday.As per details, a young girl fell into the drain in Baldia Town's Sector 12-D on Wednesday. Local residents, acting through their community support, immediately rescued the girl from the sewer.The outraged residents said that accidents are common in the area due to open manholes. They also highlighted that the roads and sewage system in the locality are in a state of disrepair.Meanwhile, UC-11 Councillor, Ashfaq Ansari, stated that funds have been received and development work is progressing rapidly. He added that the sewage system is being repaired and manhole covers are being installed to prevent future accidents.In a heart-wrenching incident that has ignited widespread fury across Pakistan’s largest city, three-year-old Ibrahim Nabil’s lifeless body was recovered from a sewage drain nearly 15 hours after he slipped into an uncovered manhole near NIPA Chowrangi in Gulshan-e-Iqbal.The tragedy unfolded around 10 p.m. on Sunday when Ibrahim, the only child of his parents Nabeel and his wife, accompanied the family for a routine shopping trip at the Chase Up departmental store adjacent to the NIPA flyover.As the family exited the store, Nabeel paused to unlock his parked motorcycle in the bustling parking area.In a fleeting moment of distraction, the curious toddler slipped from his father’s grasp, darted ahead between the vehicles, and plummeted into a 2×2-foot open manhole—three feet deep and part of the city’s main 36-inch drainage line repurposed for sewage.Eyewitnesses described the manhole as a gaping hazard, its cover missing for several days, with no protective barriers in sight despite its location in front of a high-traffic commercial hub.

Pakistan and Kyrgyzstan have reaffirmed the shared resolve to elevate their relations by enhancing cooperation in political, trade, connectivity, energy, agriculture, education, defense and cultural domains.The affirmation was made at a meeting between Prime Minister Shehbaz Sharif and the President of Kyrgyzstan Sadyr Zhaparov in Islamabad here today.Later addressing a joint press stakeout along with the Kyrgyz President, Prime Minister Shehbaz Sharif noted that Pakistan and Kyrgyzstan share links that are not merely historic but are timeless.He mentioned that both the countries have nurtured a relationship grounded in mutual trust, respect and shared aspirations since the establishment of their diplomatic relations.Describing his talks with the Kyrgyz President as fruitful, Shehbaz Sharif said we have detailed exchange of views in bilateral relations as well as important regional and international developments.Pakistan PM said the fifteen MoUs and agreements signed today between the two countries will serve as a framework for structured and result oriented engagement and closer institutional linkages in various fields of mutual interest.The prime minister said Pakistan is a gateway to the Indian Ocean and stands ready to provide Kyrgyzstan access to regional and global markets through its ports.He said our discussions highlighted the need to strengthen people to people exchanges through cultural initiatives, tourism promotion and academic partnerships.He said the two sides have agreed to hold cultural events in each other's countries. He said this will further reinforce the solid foundation of our friendship and brotherhood.In his remarks on the occasion, the President of Kyrgyzstan, emphasized that Pakistan is our important partner in South Asia.

ISLAMABAD: Khyber Pakhtunkhwa has demanded to include the share of former FATA region in the inaugural session of the 11th National Finance Commission (NFC), as the province's demands surfaced on Thursday.The KP has demanded to increase the weightage of the fight against terrorism from one percent to three percent and enhancing the province's aggregate share to 19.62 % from existing 14.62 percent.The province has also demanded resolution of the issues related to Article 161 of the constitution.KP has recommended amendment in the excise duty's distribution formula and review of the excise duty imposed on gas.The province has proposed resolution of disputes with regard to the windfall duty.The provincial government has also demanded setting a monthly schedule of the NFC sessions."Existing NFC has not been in accordance with the Article 160, it has been constitutionally contentious owing to non-inclusion of the former FATA region," KP government argued.KP and Sindh provinces have also opposed decreasing the provincial share in the resources' distribution.Current Resources SharingUnder the current distribution formulae, the Centre's share has been 42.5% and the provinces' 57.5%.Punjab having 51.74% share of the provinces total sharing amount, Sindh 24.55% share, Khyber Pakhtunkhwa 14.62% share including an additional 1% for its role in the war on terror.Baluchistan having 9.09% share from the total share of provinces in federal resources.

LAHORE: The Lahore High Court (LHC) has dismissed a petition challenging the amendments to the Punjab Motor Vehicle Ordinance, declaring it inadmissible, ARY News reported on Thursday.The recent amendments to the Punjab Motor Vehicle Ordinance, proposing heavy fines, were challenged in the high court by Asif Shakir Advocate.During today's hearing, Chief Justice LHC, Justice Miss Aalia Neelum stated that the government has enacted the law, and citizens are required to follow it.The high court remarked that higher fines are intended to prevent violations and improve society.The Chief Justice noted that underage children ride motorcycles at high speeds and that parents often fail to exercise responsibility.She highlighted that legislation is necessary to make citizens accountable. According to the police, around 5,000 children were injured or killed in accidents resulting from one-way traffic violations.Under the new traffic reforms, vehicles with repeated traffic violations will be auctioned. Government vehicles will also face heavy penalties for breaking traffic laws.A 30-day grace period has been granted to curb wrong-way driving, while U-turns will be redesigned to improve organization and enhance road safety. It has also been agreed that compensation (diyat) will be provided promptly to the families of those who lose their lives in accidents.Marriage halls without designated parking areas will not be granted construction approval. A strict crackdown has been ordered to stop underage driving, and vehicle owners may face imprisonment of up to six months if minors are found driving their cars.Traveling on the roofs of buses has been banned across Punjab, with immediate enforcement. In Lahore, Qingqi rickshaws have been completely banned from five model roads.

In the aftermath of the tragic NIPA manhole tragedy, the Sindh Police have taken further administrative action over negligence, ARY News reported on Thursday.Three-year-old Ibrahim, who came for a shopping from departmental store near NIPA Chowrangi, fell into an open manhole outside the store and later his lifeless body was retrieved.The tragedy sent shock waves across the country specially in Karachi.According to the details, DSP New Town, Moin, known as “commando,” has been relieved of his duties, according to a notification issued by IG Sindh.Moin has been directed to report to the Central Police Office. Sources indicate that action was taken after the child involved in the NIPA incident was summoned to the SSP office.In addition, both SSP East and another DSP have also been removed from their positions as part of the ongoing accountability measures related to the incident.On Wednesday night, Chief Minister (CM) of Sindh Murad Ali Shah suspended high-ranking officers over the tragic death of a child who fell into an open manhole near NIPA.The suspended officers belong to the Karachi Metropolitan Corporation (KMC), the Town Municipal Corporation (TMC) Gulshan-e-Iqbal, the Water and Sewerage Corporation, the office of the Assistant Commissioner Gulshan-e-Iqbal, and other departments.The Local Government Department has issued suspension notifications for these officers.The suspended officials including, Senior Director Municipal Services, Imran Rajput, Rashid Fayyaz, Assistant Engineer of TMC Gulshan-e-Iqbal, Waqar Ahmed, Executive Engineer, Water and Sewerage Corporation, Amir Ali Shah, Assistant Commissioner, Gulshan-e-Iqbal and Salman Farsi, Mukhtiar Kar Gulshan-e-Iqbal.

The Ministry of Foreign Affairs (FO) Thursday clarified that the individual arrested in Delaware, United States (US), on weapons possession and attack planning charges is not of Pakistani origin.According to the spokesperson, Luqmaan Khan is an Afghan citizen. He was previously reported in media as a Pakistani-origin youth, but this has been corrected.Luqmaan Khan, 25, was arrested on November 24. Authorities recovered heavy firearms and ammunition from his vehicle and residence. He had allegedly planned an attack on the University of Delaware’s Police Department, and documents related to the plot were also seized.Charges of illegal possession of a machine gun and planning an attack were filed against him on November 26, and he is scheduled to appear in court on December 11.During the investigation, officers also discovered a handwritten diary allegedly detailing plans to launch a large-scale attack on the University of Delaware’s campus police department.The notebook included a hand-drawn map of the campus police headquarters, clearly marking entry and exit points. Phrases such as “kill all” and references to “martyrdom” heightened investigators’ concerns.Prosecutors say the suspect appeared fully prepared to carry out the attack, and the equipment found in his possession indicates a serious and potentially catastrophic plot.

ISLAMABAD: The cost of health and education services across Pakistan rose significantly within a month, ARY News reported on Thursday, citing Pakistan Bureau of Statistics (PBS) report.The PBS in its report revealed that the health sector become 6.99 per cent more expensive in urban areas, while in rural areas the increase was 9.65%. Medicines saw a price hike of 6.94%, whereas therapeutic appliances and medical equipment rose by 2.19%.Doctor consultation fees increased by 7.37%, dental services by 8.36%, and medical tests by 10.72%. Hospital services in urban areas became 5.21% costlier during the month.The education sector in cities witnessed an 8.24% increase.In rural areas, the prices of drugs and medicines rose by 8.35%, doctor’s clinic fees surged by 16.16%, dental services by 17.13%, and medical tests by 11.13%. Hospital services recorded a 6.88% increase, while the education sector became 11.22% more expensive.Stationery items in rural areas also saw a rise of 2.27%.PBS data highlights a widespread monthly surge in essential health and education-related services across both urban and rural regions.Separately, Pakistan’s trade deficit widened to $2.75 billion in July 2025, marking a 16.02% increase compared to June 2025, according to the latest data released by the Pakistan Bureau of Statistics (PBS).Pakistan’s exports also witnessed an increase of 16.91 percent during the first month of the current fiscal year (July) as compared to the corresponding month of last year, the Pakistan Bureau of Statistics (PBS).According to PBS data, the exports in July (FY2025-26) were recorded at $2.697 billion as compared to the exports of $2.307 billion in July (FY2024-25).

The Sindh Building Control Authority (SBCA) demolition team carried out a late-night operation and razed illegal constructions in a residential society located in Karachi's district east, ARY News reported.Illegal structures in Admin Society were demolished during the operation conducted by SBCA’s demolition unit.Earlier in the day, armed men had attacked SBCA staff who had arrived to demolish the same structures, leaving four officers injured.Police officials stated that the operation targeted the building’s illegally constructed additional floors. Pillars, roofs and walls were demolished, while construction steel was also seized.A heavy contingent of police remained deployed to prevent any untoward incident.The SBCA Director General said that the four officers injured in the daytime attack are currently under treatment at the hospital.The officials sustained head injuries, and their CT scans are being conducted. A formal case will be registered against the attackers based on the officers’ statements. The DG further added that strict legal action will be taken against all those involved in assaulting the SBCA team.In a separate incident in Sector 48-B, Zaman Town area of Korangi, an operation jointly conducted by the Karachi Development Authority (KDA), the Anti-Encroachment Force, and police came under attack from an angry crowd.The team was demolishing illegal structures when enraged residents attacked them and tore the uniform of one police officer.The administration called in an additional police contingent to restore order. The KDA later suspended the operation due to the volatile situation.A third incident took place on M.A. Jinnah Road, where an Anti-Encroachment team arrived to conduct an operation. Unknown attackers set fire to an official truck carrying seized goods, completely destroying both the vehicle and the goods.

Karachi: Chief Secretary Sindh Asif Hyder Shah has removed Deputy Commissioner East Ibrar Ahmed Jafrey and Inspector General (IG) Sindh has removed Senior Superintendent of Police (SSP) East, Dr Farukh Raza, from their posts following the death of a child who fell into an open manhole near NIPA on Sunday night, ARY News reported. The Chief Secretary Sindh has issued a notification confirming his removal from the post. Ibrar Ahmed Jafey has been directed to report to the respective department. Meanwhile, Deputy Commissioner Malir Sami Ullah Nisar has been given the additional charge of DC East. On the other hand, Inspector General (IG) Sindh Ghulam Nabi Memon has issued the notification in this regard. The SSP has been directed to report Central Police Office. Sources said that the SSP East has been removed from his post over wrongly giving an award to a child who was stated to have recovered the dead body of the child Ibrahim, who had fallen into a manhole near NIPA ; however, the later investigation found that KMC and its staff recovered the body. Over this fault, the SSP East has been removed from his post. Earlier, Chief Minister (CM) of Sindh Murad Ali Shah on Wednesday night suspended high-ranking officers over the tragic death of a child who fell into an open manhole near NIPA, ARY News reportedThe suspended officers belong to the Karachi Metropolitan Corporation (KMC), the Town Municipal Corporation (TMC) Gulshan-e-Iqbal, the Water and Sewerage Corporation, the office of the Assistant Commissioner Gulshan-e-Iqbal, and other departments.The Local Government Department has issued suspension notifications for these officers.According to details, CM Sindh Murad Ali Shah has suspended:Imran Rajput, Senior Director Municipal ServicesRashid Fayyaz, Assistant Engineer of TMC Gulshan-e-IqbalWaqar Ahmed, Executive Engineer, Water and Sewerage CorporationAmir Ali Shah, Assistant Commissioner, Gulshan-e-IqbalSalman Farsi, Mukhtiar Kar Gulshan-e-IqbalThe CM Sindh had earlier directed the Chief Secretary Sindh to fix responsibility for the uncovered manhole incident that claimed the life of an innocent child.Murad Ali Shah has also ordered Mayor Karachi Murtaza Wahab to hold a press conference on the matter tonight at 10 p.m.Earlier in the day, Karachi Metropolitan Corporation (KMC) has dispatched its inquiry report to the Secretary Local Government on falling of three-year-old Ibrahim into an open manhole in front of a shopping mall near NIPA Chowrangi in city.Senior Director Municipal Services Imran Rajput said that the municipal services had initiated search for the boy and dead body of the child was recovered from a link nullah of Gulshan Town, according to the report.“It was found in the examination that the BRT project’s construction was the cause of the mishap,” report read. “The BRT project excavations have thoroughly damaged the drainage system of the nullah”.According to the report’s findings, temporary two-feet covers were used to try to close manholes. “Tragic incident happened because a side of the manhole was open,” report said.“The KMC doesn’t use sub-standard covers and the modus-operandi by which the gutter was covered,” KMC report said.“The BRT didn’t inform the KMC prior to the beginning of its work”. It initiated excavations and afterwards ignored the situation.The report holds store’s management and the BRT jointly responsible for the tragedy in which the toddler falls in the manhole and died.The report also informed that all excavated spots have been filled under the supervision of the officials.

Karachi: Following a huge protest and public outrage over the death of three-year-old Ibrahim, who fell into an open manhole near NIPA, Mayor Karachi Murtaza Wahab has apologized to the child's parents and family, ARY News reported.Holding a press conference after visiting the family, the Mayor said he sought an apology from Ibrahim's family without engaging in a blame game.Ibrahim's family, in turn, expressed the hope that such an incident should not happen to any other child.Mayor Wahab stated that he apologized on behalf of the administration and the government. He also informed the family about the details of the meeting chaired by Chief Minister Sindh Murad Ali Shah.The Mayor Karachi confirmed that an engineer of the Water Corporation, a senior director of the KMC, the Assistant Commissioner, and the Mukhtiar Kar have been suspended, and the suspension of the Senior Superintendent of Police (SSP) East and the Deputy Commissioner (DC) East is currently underway.Murtaza Wahab said that a precedent is being set to prevent such incidents in the future, adding that the initial response to the tragedy was not up to the expected standard.He emphasized that the government wants to learn from its faults and mistakes and avoid them in the future.The Mayor admitted that he could not be successful as a Mayor if such incidents occur and stressed that the response in such situations should be impressive to avoid damage.Karachi Mayor Murtaza Wahab has stated that the city has 245,000 manholes, and admitted that covering these manholes is the responsibility of Karachi Water Corporation (KWC), the organisation is also under his authority.After admitting responsibility, the Mayor, in the very next moment, also placed the responsibility on the Karachi Metropolitan Corporation (KMC), the town administrations, and the elected local representatives."“While installing manhole covers is primarily the responsibility of the Water Corporation, nowhere is it written that KMC or town administrations cannot install covers where needed,” Murtaza Wahab noted.He stressed that “local elected bodies also carry the responsibility of ensuring that sewerage covers are in place,” adding that it is inappropriate for any official to claim they were unable to install a cover.Murtaza Wahab said that Union Committee (UC) chairmen previously claimed they received only Rs 0.5 million, but the current administration has raised the allocation to Rs 1.2 million, adding that they must now also play their part.Mayor Karachi claimed that town administrations have access to millions, even billions of rupees, intended specifically to address such civic problems.“If towns have not worked in the past, then they should start working from today,” the mayor emphasised, adding that constant criticism without action would no longer be acceptable.Referring to a recent incident, Wahab stated that on 17 November, a truck had damaged a manhole cover, but no one reported it afterwards.

ISLAMABAD: Senator Faisal Vawda a direct warning to Pakistan Tehreek-e-Insaf (PTI), saying that the government’s response would begin from 4 December (Today), and those “challenging the state” would face immediate consequences.Speaking in ARY News’ programme Eleventh Hour, Vawda said that if PTI continued what he described as confrontational politics, the authorities would have “no option left but to impose Governor’s Rule,” adding that action would not remain limited to arrests.According to Faisal Vawda, “from Thursday onward,” PTI would see a clear shift in the government’s posture, warning that those involved in provoking unrest would be “dragged in” and dealt with strictly.Faisal Vawda also claimed that arrangements were underway to act against individuals abroad who, according to him, were “inciting political disorder,” saying their “pulse can be pressed in many ways even if they cannot be brought back.”Vawda stated that the Khyber Pakhtunkhwa chief minister would not meet the PTI founder on coming Wednesday, citing a high court order that bars the use of provincial machinery for political meetings. He maintained that family visits were allowed, but political discussions inside the prison would not be permitted.He also said that lawyers could meet the PTI founder strictly for case-related matters, not for political strategy.In a series of harsh remarks, Vawda accused PTI’s current leadership of “ingratitude,” saying that when the PTI founder was rising politically, “we were the ones standing with him in Karachi when he could not even set foot here.”He said that during his time with the party, he had always respected the PTI founder and learned from him, adding that he was expelled “for his well-being.”Faisal Vawda also criticised the social media account operating in PTI’s name, saying the people behind it “did not have the courage to name him directly.” He said he was unaware who was running the account and termed them “political orphans.”He alleged that KP was still sheltering suspects involved in the May 9 incidents and said the state would take action. According to him, those cases would now be taken to their “logical conclusion.”Vawda added that Governor’s Rule, if imposed, would “not last merely two months” and would continue as long as needed.Faisal Vawda defended the military, saying Pakistan Army had defeated “a much larger enemy” and continued to make sacrifices. He accused PTI of targeting the institution to “appear strong,” warning that such behaviour would result in a severe response.He said that if anyone crossed “red lines,” their “tongue would be pulled out,” and those challenging the military leadership would face strict consequences.Vawda asserted that, as of now, “there is no possibility” of the PTI founder being allowed back into mainstream politics.He claimed that despite facilitating an earlier meeting “with a good heart,” PTI resumed what he called “abusive behaviour,” after which, according to him, the state had decided to respond firmly.Faisal Vawda said notifications related to the CDF and administrative changes were in process and could be issued “within 72 hours.” He added that a new secretariat would be formed with rules and appointments soon.He claimed that PTI, which “boasts of 4.5 crore supporters,” could not even gather 4,500 people, saying the party was “making noise now, but from Thursday their drum will beat.”

Lahore: The Punjab government has introduced the Green Credit Program, an initiative designed to encourage people to rely on solar energy.The Environment Protection and Climate Change Department (EPCCD) has launched the program, urging the public to conserve energy and improve the environment.To promote the use of solar appliances, the government has introduced the Green Credit.A single Green Credit Card is priced at Rs 10,000.Through this card, citizens can purchase solar appliances such as solar stoves, solar geysers, solar energy savers, and solar fans.People can register to obtain a card at the following link: greencredit.punjab.gov.pkEarlier in November, Chief Minister Punjab Maryam Nawaz Sharif started a remarkable initiative to dispose of waste in the province, as she directed the authorities concerned to install colored dustbins in all markets, shopping malls, commercial centers, government offices and educational institutions.In Phase-I, approval was given in September last year to implement ‘Smart Waste Management Process’ in government and private educational institutions across Punjab.Yellow BinsPaper, packaging materials and garbage will be collected in yellow bins;Green BinsBottles, glass pieces, and waste materials used in laboratories will be put in green bins;Purple (gray) binsFruit peels, waste food, leaves and rotten vegetables will be thrown in purple (gray) bins;Red binsWhile Red bins will be used for iron and other metal waste.Orange binsOrange bins will be used for plastic waste.These items will be used to make them reusable, and the aim of this innovative method is to reduce the amount of waste and promote environment-friendly behaviors.Environmental Protection Agency (EPA), implementation of the project, has issued an official notification in this regard.Educational institutions can also contact Punjab Management Helpline (1139) to collect waste, while the Local Government and Community Development Department will play its role in managing the colored waste.The initiative is also aimed at meeting the United Nations Sustainable Development Goals related to cleanliness in cities and bring Punjab at par with global standards.Yesterday, the Punjab government imposed a ban on Qingqi rickshaws on five important highways of Lahore, ARY News reported.The provincial government has banned Qingqi rickshaws on Mall Road, Jail Road, and Canal Road.Besides that, Qingqi rickshaws have also been banned on Main Boulevard Gulberg and Main Ferozpur Road.It appears the government has banned the Qingqi rickshaws for the smooth flow of traffic, avoiding congestion on the vital thoroughfares of the city.The Punjab government has announced the measure to curb smog and improve air quality.

© Copyright 2026, All Rights Reserved